-

Socrate e-Invoice

Simplifying commercial relations with your business partners

-

What is Socrate e-Invoice?

Starting from 2022, economic operators who sell products with high fiscal risk (B2B) and those who carry out economic activities in relation to the state (B2G) have the obligation to issue electronic invoices and transmit them through the national RO e-Invoice system.

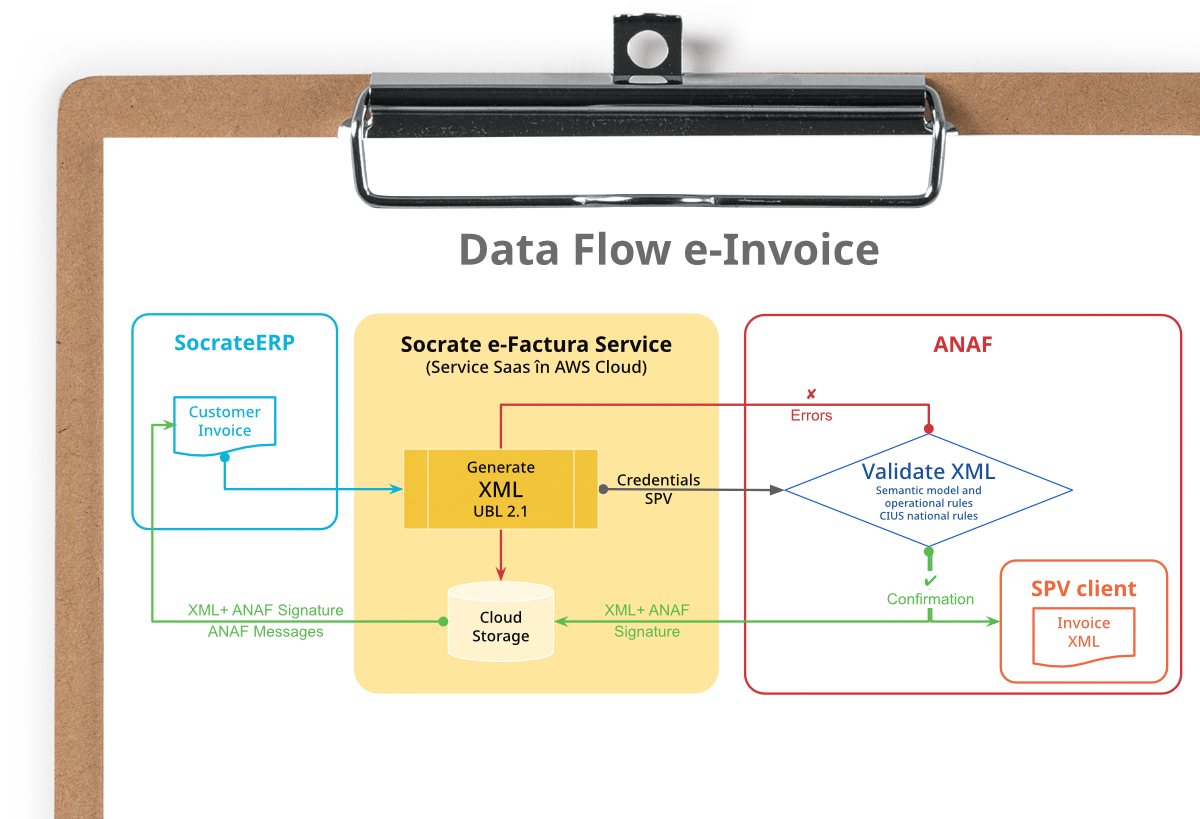

Socrate e-Invoice, a SaaS service developed by BITSoftware, native AWS Cloud, allows sending invoices to the RO e-Invoice system in the standardized format required by ANAF and managing the received messages, in accordance with the requirements of the legislation.

-

What functionalities does Socrate e-Invoice offer?

Socrate e-Invoice offers the registration of invoices at ANAF in electronic format, in accordance with the legislation that introduces the National Electronic Invoicing System RO e-Invoice for public institutions and companies operating in Romania, according to GEO 120/2021, having the following functionalities:

Secure access and management of operation authentication with the ANAF service

Conversion

to XML format

with its validation

Sending

invoices to ANAF

in electronic format

Management

of response messages

from ANAF

Storage

of electronic

invoicesAll invoices sent or received are considered communicated from the date of their validation at ANAF RO e-Invoice, when the electronic signature (electronic seal) of the MFP (Ministry of Public Finance) is also applied to them. The service will also offer PDF invoice downloads from Q4 2022.

-

Who is the Socrates e-Invoice service for?

The registration of invoices in the ANAF RO e-Invoice service is mandatory for:

1. All B2G (Business to Government) transactions specific to public procurement

2. All B2B (Business to Business) transactions, containing products with high fiscal risk, as listed in OPANAF 12/2022:

● vegetables, fruits, edible roots and tubers, other edible plants

● Alcoholic beverages

● New constructions

● Mineral products (natural mineral water, sand and gravel)

● Clothing and footweCompanies that are not legally bound but wish to use the RO e-Invoice system, can opt for registration in the RO e-Invoice Register by completing and submitting declaration 084.